- A group opportunity. Invite your friends.

-

5 people are interested

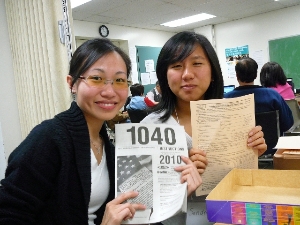

VITA Tax Preparer

ORGANIZATION: The East Bay Asian Local Development Corporation

Please visit the new page to apply.

- A group opportunity. Invite your friends.

-

5 people are interested

Tax Preparers assist low-income wage earners complete their tax returns. Tax Preparers receive free training and are certified by the IRS.

Responsibilities:

- Conduct intake interviews to fully understand taxpayer’s tax situation and ensure the correct tax law is applied and all allowable credits are claimed.

- Provide high-quality tax return preparation and answer tax-related questions for all taxpayers.

- Assist taxpayers with electronically filing returns whenever possible.

- Contact the site coordinator or IRS support hotline for assistance when necessary.

- Provide information about other programs, such as food stamps, that taxpayers may be able to utilize (if applicable at your VITA site).

- Review completed returns for accuracy if certified to the Intermediate level.

- Ensure a copy of the completed tax return is provided to the taxpayer.

- Encourage clients to save a portion of their refund as a savings bond or in a savings account or safe and secure prepaid debit card.

- Maintain confidentiality of taxpayer information.

- Ensure no compensation of any kind is accepted for volunteer services provided.

Requirements:

- Successfully pass the IRS certification test on required tax law knowledge.

- Only prepare returns within your certification scope (i.e. only Advanced preparers can help clients with itemized deductions).

- Read all communications and updates on tax requirements or procedural changes.

- Respect client privacy.

- Maintain accurate records of assistance provided.

- Give 24-hour cancellation notice when unable to volunteer at your site.

Qualifications:

- Ability to work as a volunteer one shift per week (4 hours), totaling at least 30 hours from January 24 th to April 15 th, 2017.

- Strong verbal and communication skills.

- Good interpersonal skills and comfort with a wide range of people.

- Computer skills for entering tax information (formal training will be provided).

- Ability to take initiative and work with minimal supervision.

- Commitment to strengthening families by increasing self-sufficiency.

- Basic tax knowledge a plus.

Training (to be provided by us Dec-Jan):

- Modules 1-6 required.

- Pass Basic IRS certification test. Passing score on Advanced IRS certification test optional.

- Pass the Standard of Conduct certification through Link and Learn.

We will have three orientation sessions in November and December. To sign up, please follow this link:http://tinyurl.com/jmatyy9.

If you have any questions, please contact Meg Heisler at mheisler@ebaldc.org or (510) 606-1786.

More opportunities with The East Bay Asian Local Development Corporation

No additional volunteer opportunities at this time.

About The East Bay Asian Local Development Corporation

Location:

1825 San Pablo Ave, Oakland, CA 94612, US

Mission Statement

EBALDC is a community development corporation that develops affordable housing and community facilities with integrated services focused on tenants and neighborhood residents, with emphasis on Asia Pacific Islander communities and the diverse low-income populations of the East Bay.

Description

East Bay Asian Local Development Corporation (EBALDC) is a non-profit community development organization with over 40 years of experience in building healthy, vibrant and safe neighborhoods in Oakland and East Bay. We address the specific needs of individual neighborhoods by connecting the essential elements of health and wellbeing through our Healthy Neighborhoods Approach.

EBALDC is known for developing and managing diverse, mixed-income complexes and communities, while providing vital social and financial services, to help give long-time, low-income residents the ability to stay in their neighborhoods. We know Oakland well and invest deeply in our neighborhoods. We recognize and build upon the assets unique to each community to inform and establish thoughtful partnerships that will address the social factors impacting a neighborhood’s health and wellbeing. This comprehensive perspective helps families and individuals begin a path toward healthy, stable and fulfilling lives in a holistic, sustainable way.

CAUSE AREAS

WHEN

WHERE

1825 San Pablo AvenueSuite 200Oakland, CA 94612

DATE POSTED

October 26, 2016

SKILLS

- Basic Computer Skills

- Financial Service Assistance

- ETC / Tax Assistance

- Accounting

- Bookkeeping

- Customer Service

GOOD FOR

- People 55+

- Group

REQUIREMENTS

- Must be at least 18

- Orientation or Training

- 4 hrs/week, January - April